student loan debt relief tax credit application 2021

11 2022 505 pm. How Much Student Loan Relief Do I Qualify For.

Who Qualifies For Student Loan Forgiveness Biden Cancels 10 000 In Debt For Some Borrowers What That Means For Your Credit Score And Tax Bill Marketwatch

Have at least 5000 in outstanding student loan debt upon applying for the tax credit.

. Enter the total remaining balance on all undergraduate andor graduate student loan debt which is still due as of the submission of this application. These are as follows. For tax financial debt relief CuraDebt has an incredibly professional group resolving tax financial obligation issues such as audit defense complicated resolutions offers in concession deposit.

About the Company Student Loan Debt Relief Tax Credit Application 2021. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. This application and the related instructions are for Maryland residents.

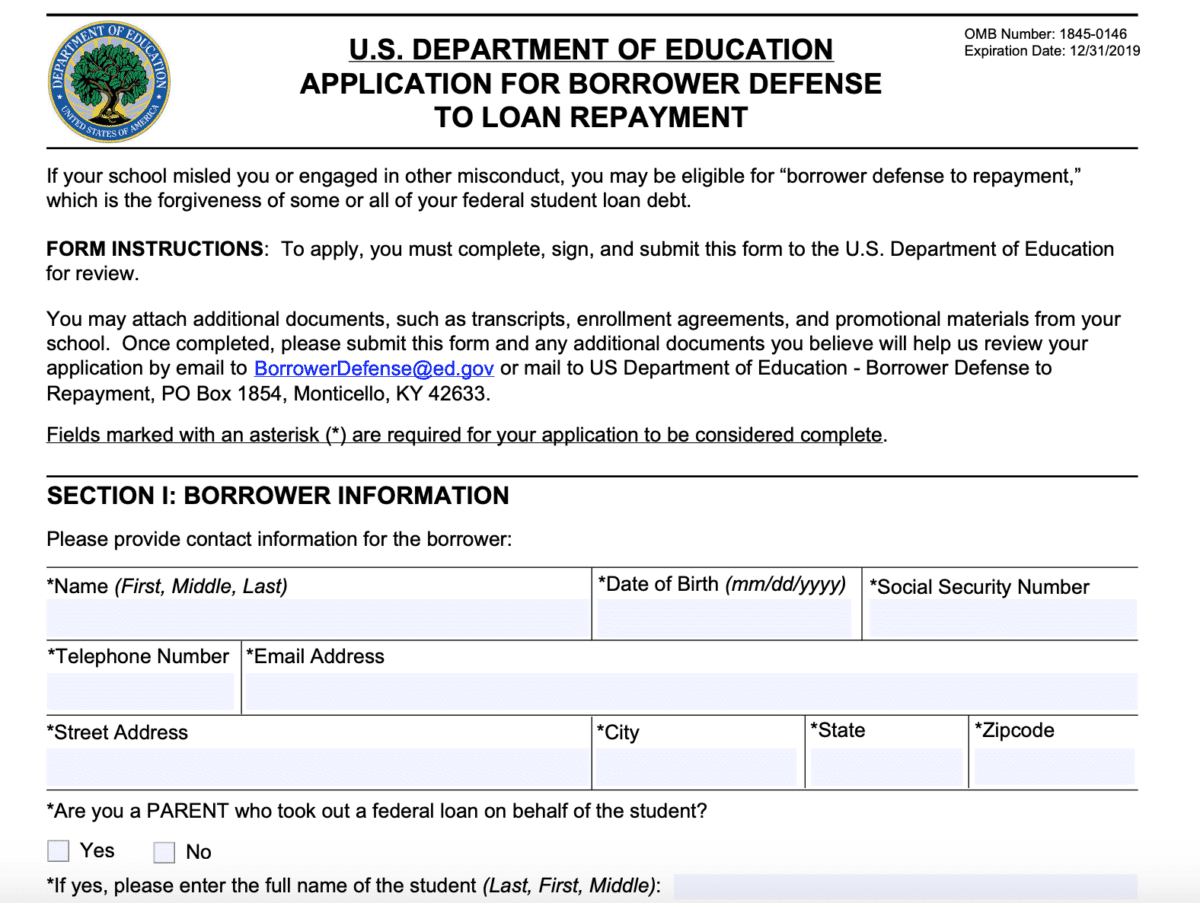

There are a few application requirements that a person must fulfill to get registered for the one-time student loan debt relief application. Free Case Review Begin Online. Regardless of whether individuals are provided with loan relief the Student Loan Debt Relief Tax Credit program still requires that if taxpayers claim the credit on their tax returns they must.

Fillablechangeable documents such as Word or Excel are not. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. It was founded in 2000 and has since become a.

Ad Obama Forgiveness Program - Apply For Income-Based Federal Benefits. Since 2017 Marylands student loan debt relief tax credit has provided over 40 million to over 40000. Changes in the Electric Vehicle Tax Credit The Inflation Reduction Act of 2022 includes changes to the credit available for electric vehicles.

Start Your Free Pre-Application Online Today. Curadebt is a company that provides debt relief from hollywood florida. Ad See If You Qualify For IRS Fresh Start Program.

If you pay taxes in Maryland and took out 20K or more in debt to finance your post-secondary education apply for the Student Loan Debt Relief Tax Credit. The site outlined that in 2021 close to 9000 residents of Maryland applied and received the tax credit. For unsafe financial obligations such as credit cards individual car loans particular personal trainee loans or other similar a financial debt relief program might offer you the service you.

Ad Explore Your Eligibility For Biden Forgiveness And Easily Apply in Minutes. How to apply for Marylands student loan debt relief tax credit. Maryland Adjusted Gross Income.

The income of the. How to apply for the Maryland Student Loan Debt Relief Tax Credit. CuraDebt is a debt relief company from Hollywood Florida.

Know Your Options So You Can Protect Your Rights. Ad Use our tax forgiveness calculator to estimate potential relief available. About the Company Student Loan Debt Relief Tax Credit Application.

CuraDebt is a company that provides debt relief from Hollywood Florida. Ad Use our tax forgiveness calculator to estimate potential relief available. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

One begins to lose rest and feels. Have the debt be in their the Taxpayers name. Millions of student loan holders are preparing for the release of the new student loan forgiveness application which was slated to open in early October according to White.

As CNBC suggested the first thing you should do is to verify if your income is under the qualifying threshold for debt relief. President Biden announced a. It was established in 2000 and is a part of the.

The application for student loan debt forgiveness was promised for an early October launch. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are. Try Our Free Forgiveness Tool To Explore Your Student Loan Forgiveness Options.

Claim Maryland residency for the 2021 tax year. Resolve Back Taxes For Less. Mhec student loan debt relief tax credit program for 2021.

The following documents are required to be included with your Student Loan Debt Relief Tax Credit Application. Check your AGI for both 2020 and 2021 because the Biden administration said it will consider either year. A week after the White.

Everyone should figure out what their AGI is for those years even if.

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

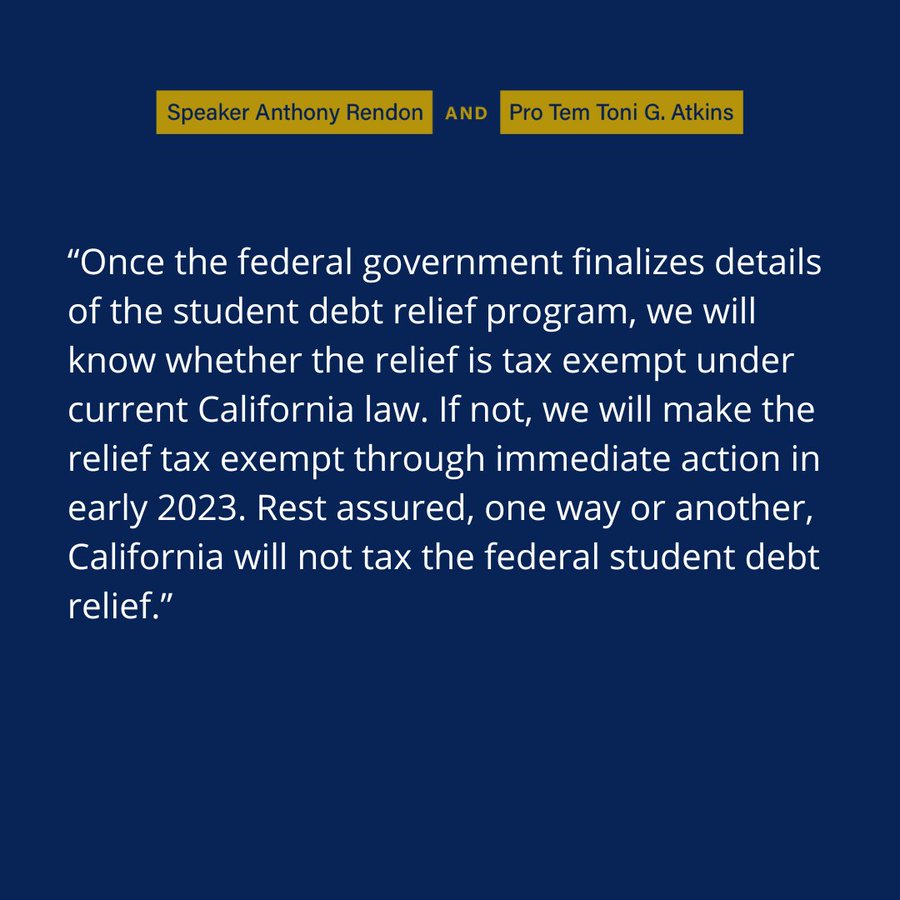

Student Loan Borrowers In 7 States May Be Taxed On Their Debt Cancellation Npr

Deadline Looms To Apply For Maryland Student Loan Debt Relief Tax Credit Wtop News

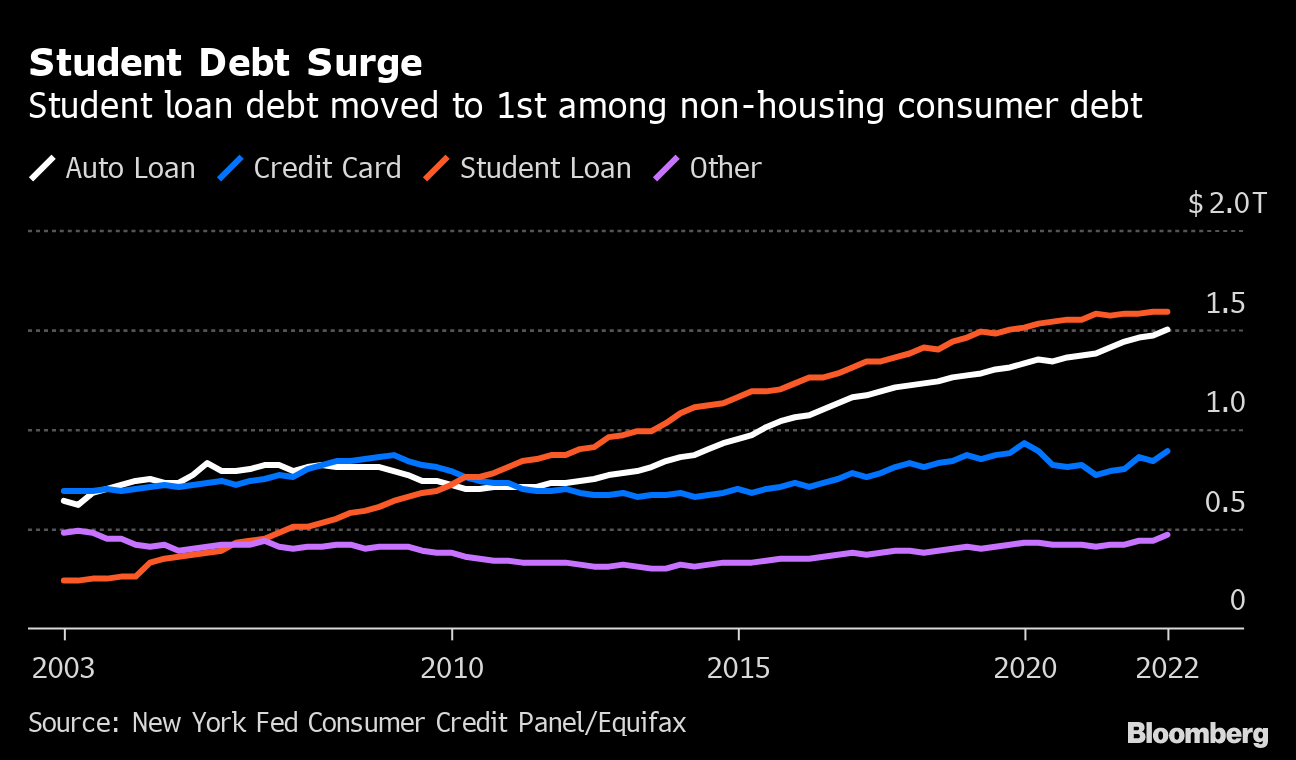

Student Loans In The United States Wikipedia

Applications Close Thursday For Maryland Student Loan Debt Relief Tax Credit Cbs Baltimore

Student Loan Forgiveness Forms Student Loan Planner

Will Biden S Student Loan Relief Add To Inflation Here S What Economists Say Bloomberg

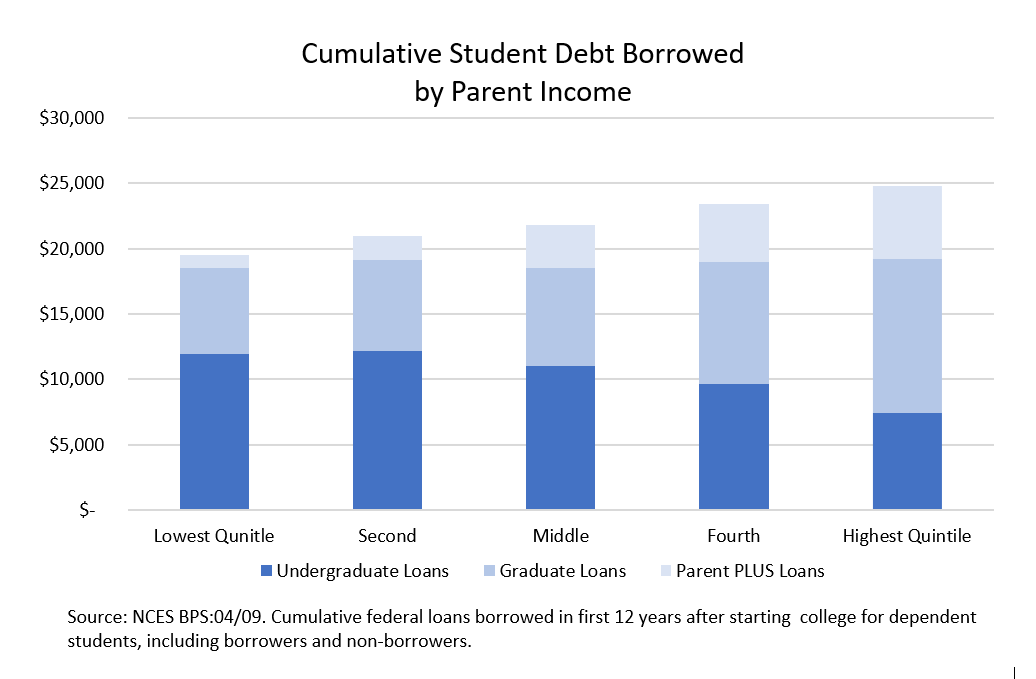

Who Benefits From Student Debt Cancellation

Can I Get A Student Loan Tax Deduction The Turbotax Blog

How To Apply For Biden S Student Loan Forgiveness Program Money

Biden Student Loan Forgiveness Faqs The Details Explained Forbes Advisor

Marylanders In Need Urged To Apply For Student Loan Debt Relief Tax Credit Wbal Newsradio 1090 Fm 101 5

Student Loan Debt Relief Tax Credit For Tax Year 2021 Details Solutosa La Solucion Total

Comptroller Of Maryland Heads Up The Student Loan Debt Relief Tax Credit Program For Tax Year 2021 Is Open For Applications Through Sept 15 If You Are Looking For Some Help

Student Loans Here S Who May Pay Taxes On Forgiven Student Debt Cnet

Student Loans The Racial Wealth Divide And Why We Need Full Student Debt Cancellation

Biden Is Right A Lot Of Students At Elite Schools Have Student Debt

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits