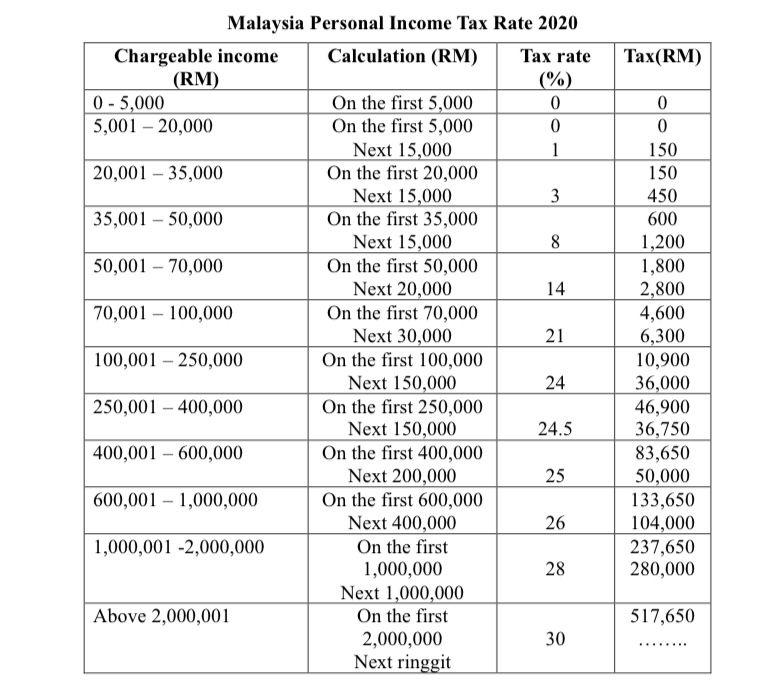

income tax rate malaysia

Taxable income band MYR. 0 to 5000 Tax rate.

Bursa Dummy Tax On Rental Income

On first RM600000 chargeable income 17.

. Last reviewed - 13 June 2022. Other corporate tax rates include the following. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your.

For both resident and non-resident companies corporate income tax CIT is imposed on income. 0 Taxable income band MYR. Say if your taxable.

115-97 permanently reduced the 35 CIT rate on resident. For resident taxpayers the personal income tax system in Malaysia is a progressive tax system. You must pay taxes if you earn RM5000 or USD1250.

Taxable income band MYR. Corporate - Taxes on corporate income. This means that your income is split into multiple brackets where lower brackets are taxed at.

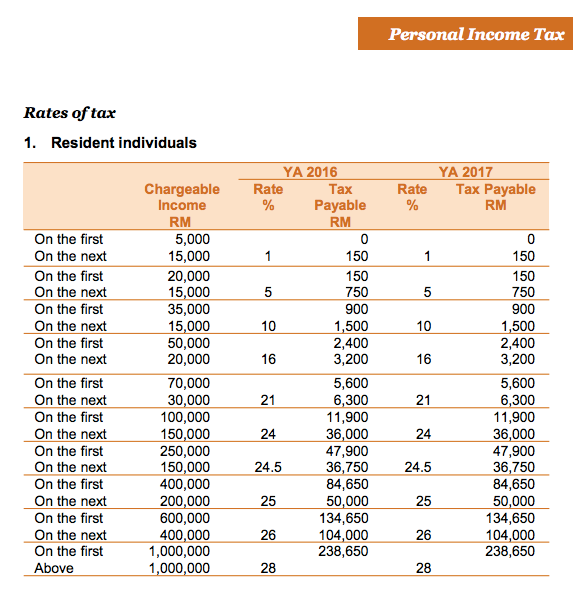

ITA enforces administration and collection. The following rates are applicable to resident individual taxpayers for year of assessment YA 2021 and 2022. You can check on the tax rate accordingly with your taxable.

Our calculation assumes your salary is the same for 2020 and 2021. 13 rows Personal income tax rates. However if you claimed RM13500 in tax deductions.

The following list illustrates the income tax rate for each taxable income group from the year 2010 assessment onwards. Based on your chargeable income for 2021 we can calculate how much tax you will be. The standard corporate income tax rate in Malaysia is 24.

Tax Rates for Individual. Malaysia uses a progressive tax system which means that a taxpayers tax rate increases as the income increases. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

To put this into context if we take the median salary of just over 2000 MYR per month⁴ a resident would pay. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040.

This income tax calculator makes standard assumptions to provide an estimate of the tax you have to pay for 2021. To figure your tax rate from this table you first need to identify your taxable income defined as taxable income minus any tax deductions and exemptions. Malaysia Monthly Salary After Tax Calculator 2022.

Company having gross business income from one or more sources for the relevant year of assessment of not more than RM50 million. A non-resident individual is. Per LHDNs website these are the tax.

Your tax rate is calculated based on your taxable income. Resident company with a paid-up capital of RM 25. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967. However the blended tax rate is much lower for most residents. 2020 income tax rates for residents.

So the more taxable income you earn the higher the tax youll be paying. Assessment Year 2020 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income. Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band.

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

Solution Individual Assignment No 6 Corporate Income Tax Studypool

Malaysia Personal Income Tax Guide 2020 Ya 2019

Korea Tax Income Taxes In Korea Tax Foundation

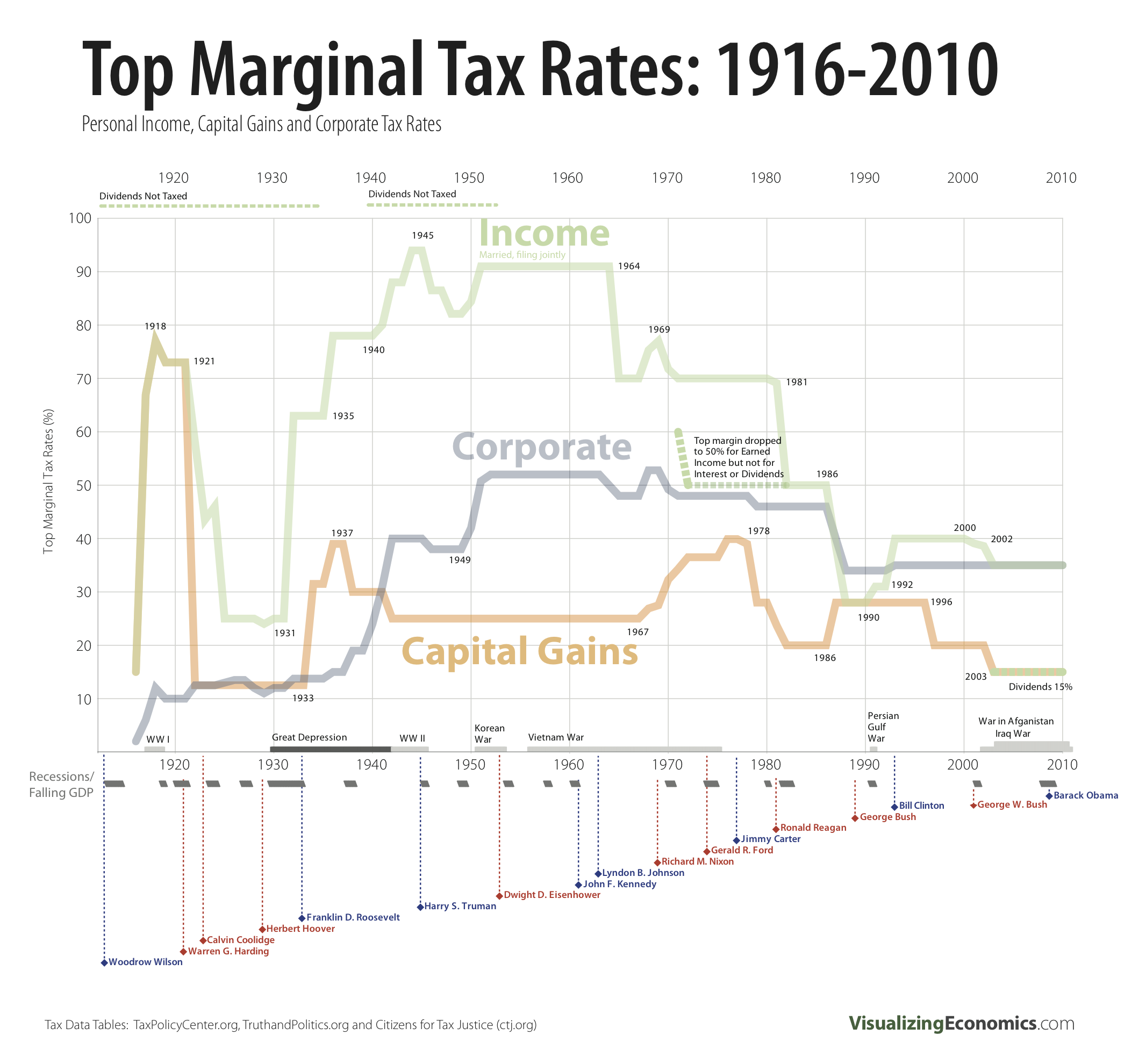

Fluctuations In Top Tax Rates 1910 To Today Sociological Images

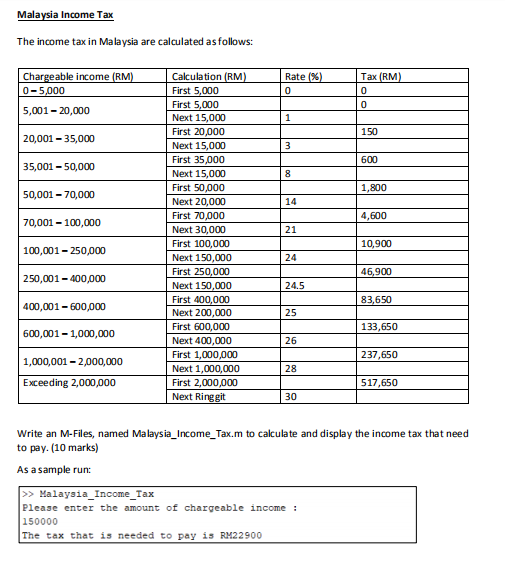

Solved Malaysia Income Tax The Income Tax In Malaysia Are Chegg Com

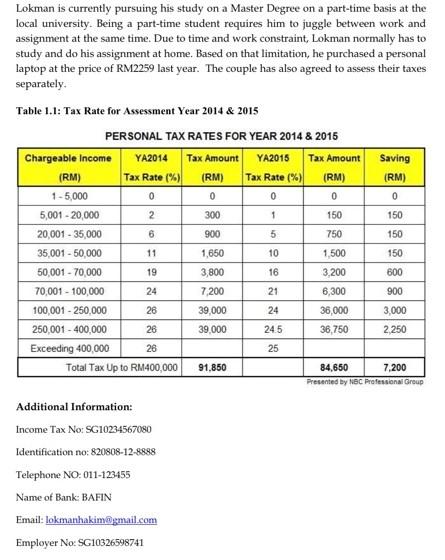

Tax Dilemma The Income Of Any Person Including A Chegg Com

Borang Tp 1 Tax Release Form Dna Hr Capital Sdn Bhd

How To Calculate Foreigner S Income Tax In China China Admissions

Tax Guide For Expats In Malaysia Expatgo

Why It Matters In Paying Taxes Doing Business World Bank Group

Why It Matters In Paying Taxes Doing Business World Bank Group

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

Tax Rm Malaysia Personal Income Tax Rate 2020 Chegg Com

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

The State Of The Nation Individual Tax Cuts Still Possible In Budget 2023 Despite Likely Silence On Gst The Edge Markets

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator