salt tax deduction calculator

Add up lines 5a 5b and 5c. Income taxes or sales taxes.

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions Business Tax Deductions Small Business Tax Business Tax

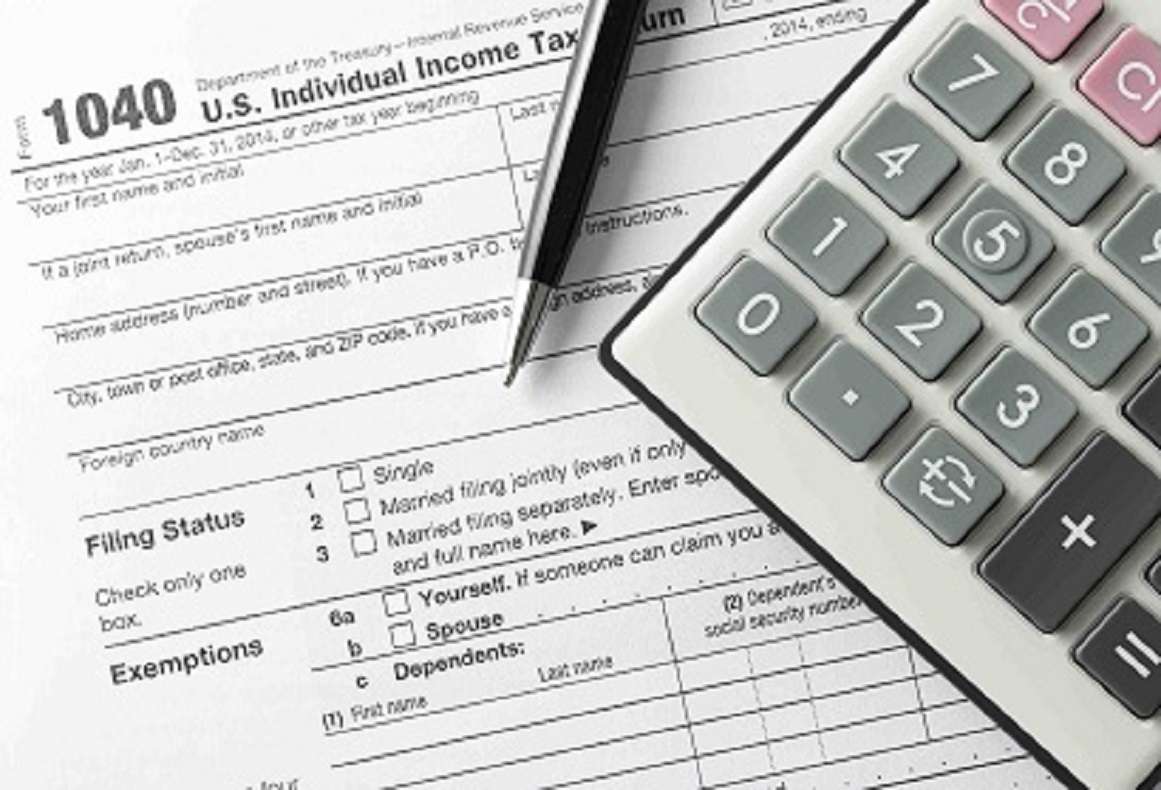

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

. Before the creation of a cap on this deduction 91 of the benefit. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. But you must itemize in order to deduct state and local taxes on your federal income tax return.

The unlimited SALT deduction allowed millions of Americans to use state and local tax bills to reduce federal taxes on a dollar-for-dollar basis. The SALT deduction applies to property sales or income taxes already paid to state and local governments. Build Your Future With a Firm that has 85 Years of Investment Experience.

Only 66 percent went to taxpayers with incomes below 50000. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. Annual vehicle registration fee for new truck.

The federal tax reform law passed on Dec. In 2016 77 percent of the benefit of the SALT deduction accrued to those with incomes above 100000. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or.

Sales Tax Deduction Calculator. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump. Our Resources Can Help You Decide Between Taxable Vs.

If your total is 10000 or less write the full amount on line 5e. Prior to the TCJA there were no restrictions on SALT deductions but beginning in 2018 taxpayers deductions were capped at 10000. Starting with the 2018 tax year the maximum SALT deduction available was 10000.

Jeff will be able to deduct 5775 3000 2500 275 on Schedule A. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. If you pay state and local taxes during 2021 in the amount of 15000 then you are allowed to take a federal tax deduction of 10000 on your IRS tax return if you itemize.

Sales Tax Deduction Calculator. Second the 2017 law capped the SALT deduction at 10000 5000 if. Estimate your state and local sales tax deduction.

And is based on the tax brackets of 2021 and. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. It is mainly intended for residents of the US.

Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. List your state and local personal property taxes on line 5c. Sales tax paid on new truck.

The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money. The SALT deduction cap was introduced as part of the Tax Cuts and Jobs Act as a means to broaden the individual income tax base and partially fund reductions in statutory tax. 52 rows The SALT deduction is only available if you itemize your deductions.

The Tax Cuts and Jobs Act. The SALT deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes they paid that year up to 10000. If your total is more than.

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. The federal tax reform law passed on Dec. Discover Helpful Information And Resources On Taxes From AARP.

If you paid 5000. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or.

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Or Standard Deduction Houselogic

Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj

Supreme Court Definitively Ends The Salt Tax Deduction Case

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What Are Itemized Deductions And Who Claims Them Tax Policy Center

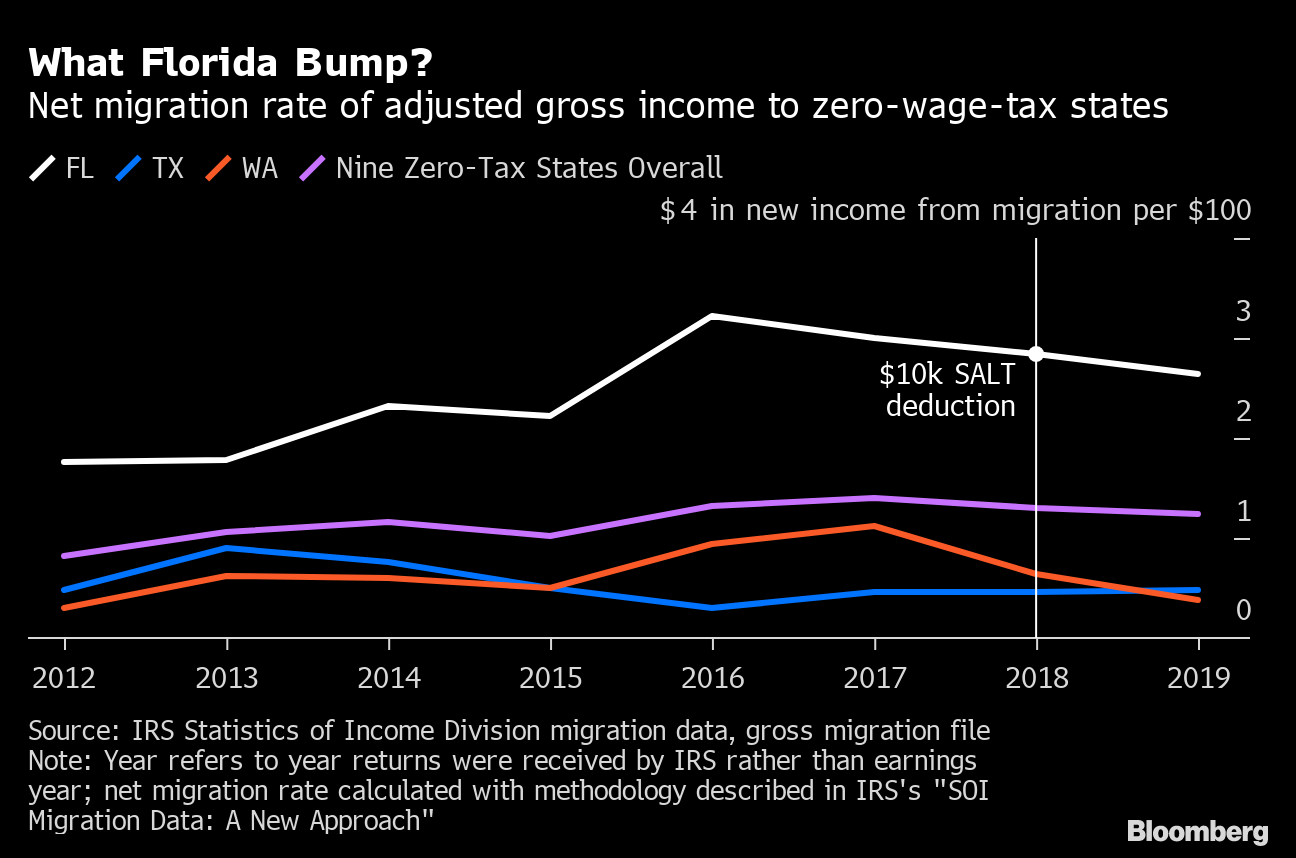

Salt Cap Confounds Doomsayers As Fears Of Exodus Prove Overblown Bloomberg

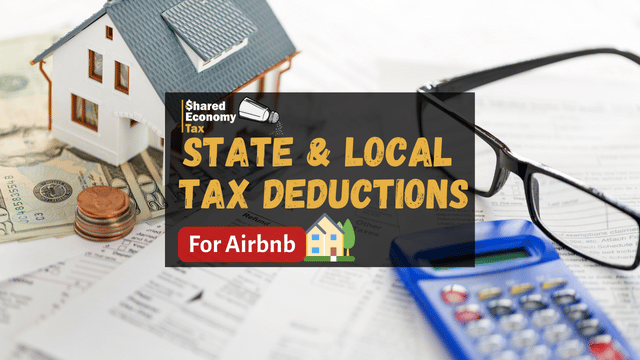

Salt Deduction Tips For Airbnb Hosts Shared Economy Tax

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

What Is Salt Tax Deduction Mansion Global

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

What Are Itemized Deductions And Who Claims Them Tax Policy Center

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)