child tax credit 2021 income limit

If not but you received payments it might just mean a reduced. The child tax credit calculator can help you figure out if you are within the income limits and how much you can get back.

Child Tax Credit 2022 Could You Get 750 From Your State Cnet

T he American Rescue Plan raised the 2021 Child Tax Credit from 2000 per child to 3000 per child for children over the age of 6 and.

. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. The CTC income limits are the same as last year but there is no longer a minimum income so anyone whos otherwise eligible can claim the child tax. Them under the Earned Income Tax Credit your child.

Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit. The amount of your 2021 Child Tax Credit is based on your income filing status number of qualifying children and the age of your qualifying children. The Child Tax Credit begins to be reduced to 2000 per child when the taxpayers modified adjusted gross income in 2021 exceeds.

The IRS allowed qualified individuals to receive 50 of their estimated child tax credit payment in 2021. More workers and working families who have income from retirement accounts or other investments can still get the credit. Since the credit is reduced by 50 for every 1000 earned over the income limit he will receive 13700 3600 x 3 3000 50 x 2.

The two most significant changes impact the credit amount and how parents. To reconcile advance payments on your 2021 return. Families that do not qualify for the credit using these income limits are still eligible for the 2000 per child credit using the original Child.

The 2021 CTC is different than before in 6 key ways. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. 2021-23Only for tax years beginning in 2021 Section 9611 of the American Rescue Plan Act increases the refundable.

Get your advance payments total and number of qualifying children in your online account. In previous years 17-year-olds werent covered by the CTC. Increases the tax credit amount.

That means the total advance payment of 4800 9600 x 50 would be sent in monthly installments from July through December. Eligibility Rules for Claiming the 2021 Child Tax Credit on a 2021 Tax Return. We dont make judgments or prescribe specific policies.

The IRS anticipates that the 2021 Instructions for Form 2441 and the 2021 Publication 503 will be available in January 2022. What is the Income Limit for the 2021 Child Tax Credit. These people are eligible for the full 2021 Child Tax Credit for each qualifying child.

For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17. However the refundability of the credit is limited similar to the 2020 Child Tax Credit and Additional Child Tax Credit. Enter your information on Schedule 8812 Form.

The Child Tax Credit phases out in two different steps based on your modified adjusted gross income AGI in 2021. The American Rescue Plan Act of 2021 raised the amount of the child tax credit to 3000 per child or 3600 per child under age 6. The 2021 Instructions for Form 2441 and IRS Publication 503 Child and Dependent Care Expenses for 2021 both will contain a chart indicating the percentage of work-related expenses allowed as a credit at each income level.

The family would receive 300 per month for the 3-year-old. For additional information on the amounts of modified AGI that reduce the 2021 Child Tax Credit see Q C4 and Q C5 below. The Child Tax Credit 2021 will give families financial relief from COVID 19.

The second phaseout can reduce the remaining CTC below 2000 per child. For all other tax filing statuses the phaseout limit is 200000. 150000 if married and filing a joint return or if filing as a qualifying widow or widower.

Ad See If You Qualify To File For Free With TurboTax Free Edition. Halfpoint Getty ImagesiStockphoto. Ad File a federal return to claim your child tax credit.

See what makes us different. The new Child Tax credit phases out with income in two different steps. The Child Tax Credit changes for 2021 have lower income limits than the original Child Tax Credit.

The maximum Child Tax Credit increased to 3600 for children under the age of 6 and to 3000 per child for children between ages 6 and 17. Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition. The first phaseout of CTC is reduced by 50 for each 1000 or fraction thereof by which your MAGI exceeds the following income thresholds.

The limit on investment income is now 10000 and will. Your adjusted gross income is what matters. The credit amounts will increase for many taxpayers.

The maximum weekly childcare costs you can claim for and percentage of costs covered are shown below. The Child Tax Credit helps all families succeed. Families with a single parent.

Big changes were made to the child tax credit for the 2021 tax year. For more information see Q B7 in Topic B. Read about the new stimulus and monthly child tax credit payments here.

Even if you dont owe taxes you could get the full CTC refund. The 2021 advance was 50 of your child tax credit with the rest on the next years return. The American Rescue Plan raised the 2021 Child Tax Credit from 2000 per child to 3000 per child for children.

112500 if filing as head of household. 112500 if you are filing as a head of household. To determine your 2021 Earned Income Tax Credit if your 2019 earned income gives you a higher tax credit.

Families that do not qualify for the credit using these lower income limits are still eligible for the 2000 per child credit using the. Removes the minimum income requirement. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Simple or complex always free. Step 1 phaseout. If your income went up in 2021 because for example you got a new job you might want to check whether youre still eligible.

Childcare element of Working Tax Credit. The tax credits maximum amount is 3000 per child and 3600 for children under 6. The Child Tax Credit changes for 2021 have lower income limits than the original Child Tax Credit.

The Child Tax Credit provides money to support American families helping them make ends meet. To be eligible for the child tax credit married couples filing jointly must make less than 400000 per year. 75000 if you are a single filer or are married and filing a.

The IRS on Monday issued adjusted amounts for the child tax credit the earned income tax credit EITC and the premium tax credit PTC for 2021 to reflect changes enacted in the American Rescue Plan Act of 2021 PL. The first phaseout can reduce the CTC to 2000 per child. Married couples filing a joint return with income of 150000 or less.

October 15 2021 1158 AM 1 min read. Makes the credit fully refundable. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

The Kiplinger Washington Editors. 150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. The IRS based your 2021 Child Tax Credit on your 2019 or 2020 income information.

The first phaseout can reduce the Child Tax Credit to 2000 per child. If you had qualifying children and income within the limits in 2021. Hell get about 1140 per month until the end.

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit Definition Taxedu Tax Foundation

Child Tax Credit 2021 8 Things You Need To Know District Capital

Here S Who Qualifies For The New 3 000 Child Tax Credit

Child Tax Credit Definition Taxedu Tax Foundation

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

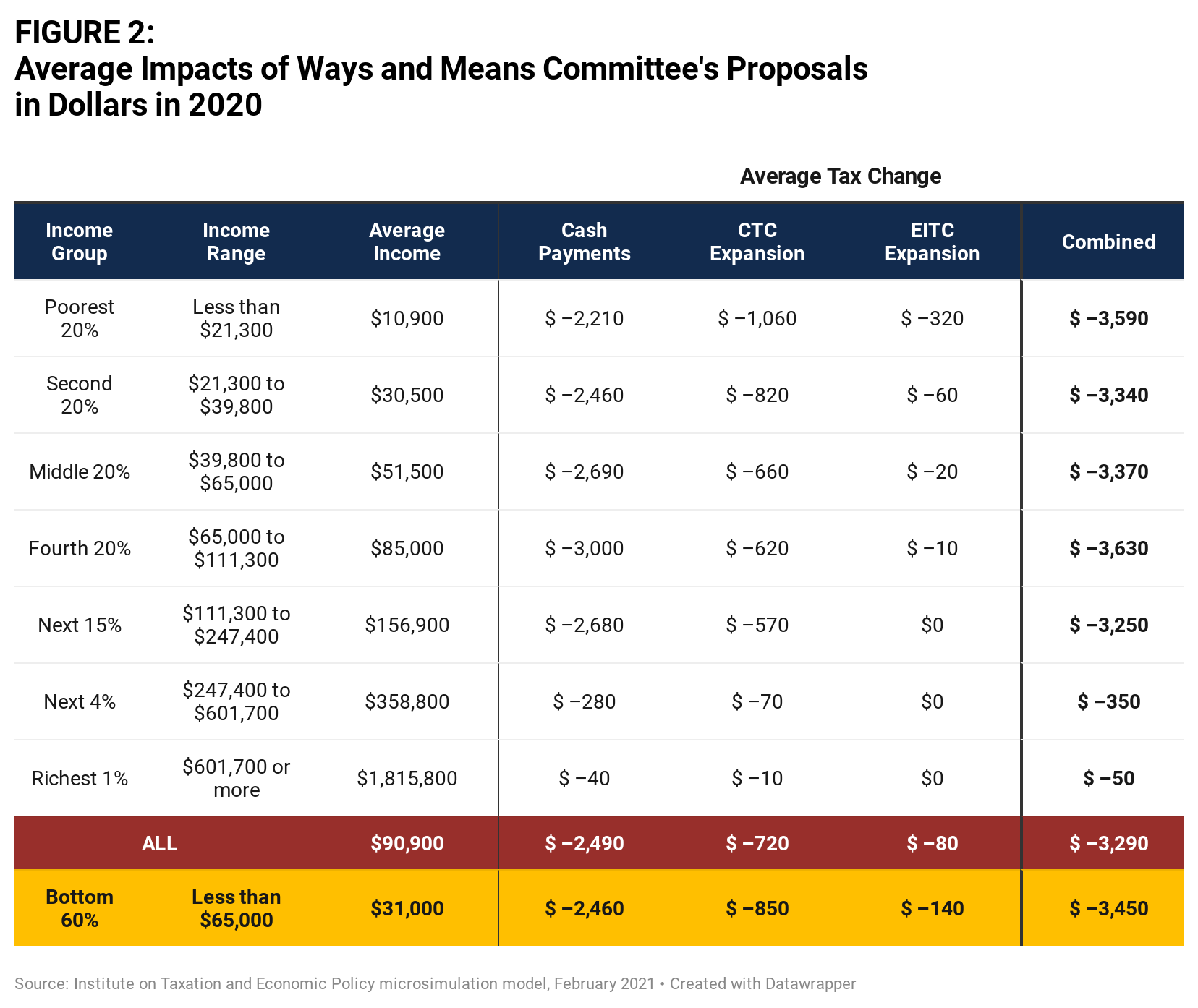

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

2021 Child Tax Credit Advanced Payment Option Tas

3 000 Child Tax Credit Payments Stimulus 2021 California Food Stamps Help

Child Tax Credit Definition Taxedu Tax Foundation

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

What S The Most I Would Have To Repay The Irs Kff

Politifact Sen Manchin Wrong On Income Limits For Child Tax Credit Extension In Build Back Better